Ukraine is known for its rich and diverse mineral wealth, which has drawn significant attention, especially in recent geopolitical events. Ukraine possesses a wide range of mineral resources, including rare earth elements vital for modern technologies like electric vehicles, renewable energy systems, and defense equipment. The country is estimated to hold around 5% of the world’s mineral resources despite covering only 0.4% of the Earth’s surface. Its standout reserves are lithium, titanium, graphite, and uranium, alongside substantial deposits of iron ore, manganese, and coal. For instance, Ukraine has some of Europe’s largest lithium reserves and graphite deposits that account for about 20% of global resources. Its titanium reserves are also significant, ranking it among the top producers globally, and these are crucial for industries like aerospace and manufacturing.

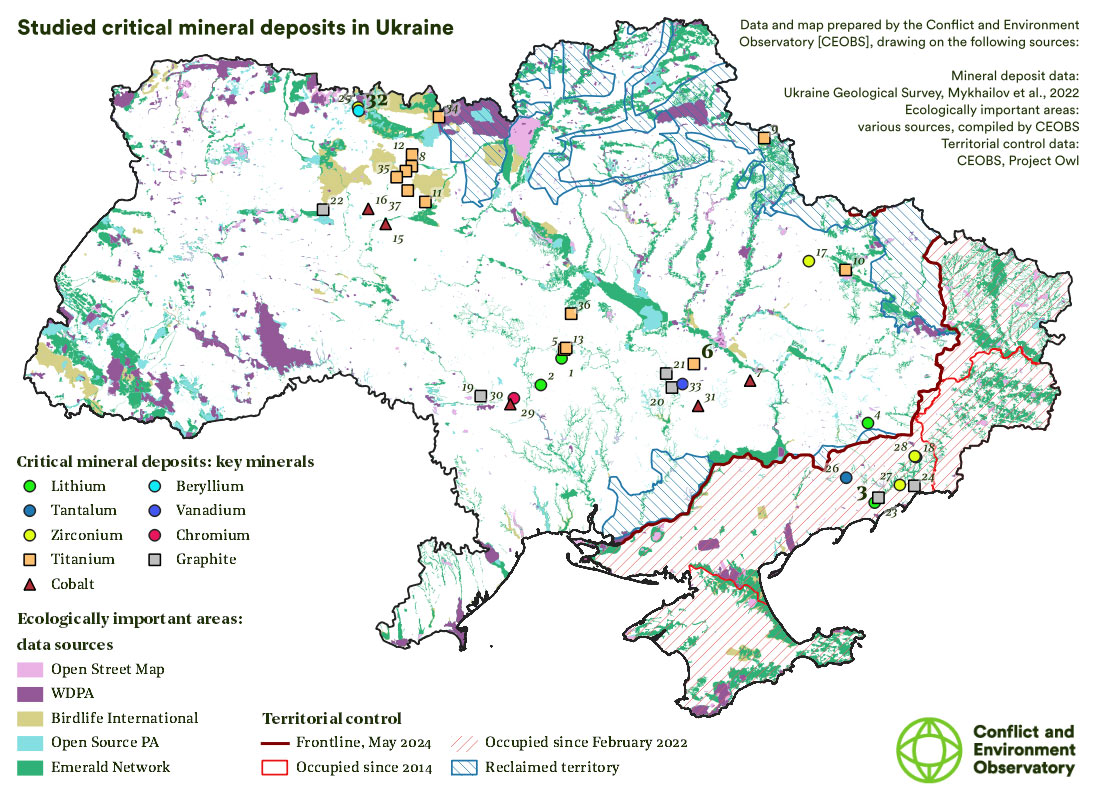

The Ukrainian Shield, a geological formation stretching from the Belarus border to the Azov Sea, is a key area for these resources. Lithium deposits, for example, have been identified around Mariupol in the Donbas region, though many remain undeveloped due to the ongoing conflict. Other critical minerals like uranium and rare earths are spread across regions such as Dnipro and western Ukraine, with some deposits still under Ukrainian control despite territorial losses to Russia.

The war has complicated access to these resources. Eastern Ukraine, particularly Donbas, holds much of the country’s coal and metal deposits, and Russia’s occupation of these areas has cut Kyiv off from about 40% of its metal resources and most of its coal reserves. Meanwhile, safer regions like Kirovohrad and Dnipropetrovsk host nickel and cobalt deposits, which are key for battery production. The value of Ukraine’s mineral wealth is debated—estimates range from hundreds of billions to over $26 trillion—but the lack of fully operational mines for rare earths and the war’s disruption means much of this potential remains untapped.

Recently, Ukraine’s leadership has pitched these resources as a bargaining chip. President Zelensky has signaled openness to partnerships with the U.S. and EU to develop them, framing it as a way to secure aid and bolster global supply chains against reliance on China, the dominant rare earth supplier. However, a controversial U.S. proposal in February 2025 to claim 50% of Ukraine’s mineral revenues was rejected by Kyiv, which insisted on security guarantees alongside any deal. Discussions continue, with Ukraine also offering the EU joint extraction opportunities for minerals like uranium and lithium.

So, Ukraine’s mineral earth is a treasure trove—strategically vital, yet caught in a tug-of-war between economic promise and wartime reality. What exactly were you looking to dig into about it?

Ukraine’s lithium reserves are a significant part of its mineral wealth, often highlighted for their potential to support the global shift toward green energy, particularly in battery production for electric vehicles and renewable energy storage. While not fully exploited, these reserves position Ukraine as a key player in Europe’s lithium landscape. Here’s a detailed breakdown based on what’s known:

Location and scale

Ukraine’s lithium deposits are primarily concentrated in three major areas within the Ukrainian Shield, a geologically rich region:

- Shevchenkivske Deposit (Kirovohrad Oblast): Located in central Ukraine, this is one of the most promising sites. Estimates suggest it holds around 14 million tons of lithium oxide ore, though exact figures vary due to limited modern exploration.

- Polokhivske Deposit (Kirovohrad Oblast): Nearby, this deposit is smaller but still significant, with potential reserves of several million tons of lithium-bearing ore. It’s often cited alongside Shevchenkivske as part of a broader lithium-rich zone.

- Krutovolozhskoye (or Dobra) Deposit (Donetsk Oblast): Situated in the Donbas region near Mariupol, this deposit has been pegged at up to 5 million tons of lithium ore. However, its proximity to conflict zones has stalled development.

Some sources estimate Ukraine’s total lithium reserves at around 500,000 tons of lithium metal content, though this is speculative without comprehensive modern surveys. If accurate, this would rank Ukraine among Europe’s largest lithium holders, rivaling Portugal’s 60,000-ton proven reserves or Serbia’s massive but controversial Rio Tinto project.

Geological context

The lithium in Ukraine is primarily found in pegmatite formations—hard rock deposits typical of spodumene or petalite minerals. These differ from the brine-based lithium sources dominant in South America. The Ukrainian Shield’s ancient crystalline rocks host these deposits, often alongside other rare metals like tantalum and niobium, adding to their economic value. The deposits are relatively shallow, which could lower extraction costs if developed, but they require advanced processing to convert into usable lithium compounds like lithium carbonate or hydroxide.

Development status

Most of Ukraine’s lithium reserves remain undeveloped. Exploration began in Soviet times, with initial surveys identifying these deposits in the 20th century, but no large-scale mining occurred. Post-independence, Ukraine issued exploration licenses in the early 2000s—some to domestic firms like the Ukrainian Geological Company and others to foreign players like Australia’s European Lithium, which targeted Polokhivske and Shevchenkivske around 2017-2020. However, progress stalled due to bureaucracy, corruption allegations, and the escalating conflict with Russia.

The 2022 invasion further disrupted plans. The Dobra deposit in Donbas is now in Russian-occupied territory, making it inaccessible to Kyiv. The Kirovohrad deposits, being west of the front lines, remain under Ukrainian control and are seen as the most viable for near-term development. In 2023, Ukraine’s government revoked some dormant licenses and began pitching these assets to Western partners, with tenders floated for foreign investment.

Economic and strategic value

Lithium’s global demand has soared, with prices peaking at over $80,000 per ton in 2022 before stabilizing around $15,000-$20,000 by early 2025. Ukraine’s reserves could theoretically supply Europe, which currently imports most of its lithium from Australia, China, and Chile. If fully operational, the Shevchenkivske deposit alone could produce tens of thousands of tons of lithium annually, enough to power millions of EV batteries. Kyiv has estimated the value of its lithium reserves in the billions, though war and infrastructure challenges cloud these projections.

Challenges:

- Conflict: The war has halted exploration in eastern deposits and deterred investment elsewhere. Russia’s control over Donbas complicates access to Dobra.

- Infrastructure: Ukraine lacks domestic lithium processing facilities, meaning raw ore would need export for refinement—likely to Europe or China—until local plants are built.

- Investment: Western interest exists (e.g., U.S. and EU talks in 2024-2025), but security risks and unclear ownership rights have slowed deals.

- Data Gaps: Soviet-era estimates need modern validation. Without updated geological surveys, reserve sizes and grades remain uncertain.

Current moves

As of February 25, 2025, Ukraine’s leadership is leveraging its lithium to secure aid. Zelensky has offered joint ventures to the EU and U.S., emphasizing lithium’s role in reducing reliance on Chinese supply chains. A rejected U.S. proposal this month sought 50% of mineral revenues for reconstruction funds, but Ukraine countered with demands for NATO-like security guarantees. Meanwhile, companies like Germany’s Vulcan Energy have expressed interest in partnering, eyeing Ukraine as a future lithium hub if peace holds.

In short, Ukraine’s lithium reserves are a sleeping giant—large, strategically located, but tangled in war and underdevelopment. Were you after specifics on a particular deposit or the geopolitical angle?

The Shevchenkivske lithium deposit, located in Kirovohrad Oblast in central Ukraine, stands out as one of the country’s most promising lithium resources. It’s often cited as a key asset in Ukraine’s bid to become a significant player in the global lithium market. Here’s a detailed look at what’s known about it:

Location

Shevchenkivske lies near the village of Shevchenkove in the Novomyrhorod district of Kirovohrad Oblast, roughly 250 kilometers south of Kyiv. This central position places it well away from the active conflict zones in eastern Ukraine, making it one of the more accessible lithium deposits under Ukrainian control as of February 25, 2025. The site is part of the Ukrainian Shield, a geologically stable region rich in hard-rock mineral deposits.

Geological characteristics

The deposit is a pegmatite-type lithium occurrence, meaning the lithium is hosted in crystalline rock formations, likely spodumene or petalite—minerals common in hard-rock lithium mining. These pegmatites are embedded in the Precambrian rocks of the Ukrainian Shield, which also contain traces of other valuable metals like tantalum, niobium, and beryllium. The lithium-bearing ore is relatively shallow, with depths estimated between 50 and 300 meters, which could simplify extraction compared to deeper deposits. The ore’s lithium oxide (Li₂O) content is thought to average around 1-1.5%, a respectable grade for hard-rock deposits, though this needs modern confirmation.

Reserve estimates

Exact figures for Shevchenkivske’s reserves are murky due to outdated Soviet-era data and limited recent exploration. Preliminary estimates suggest the deposit holds around 14 million tons of lithium-bearing ore. If the lithium oxide content averages 1.25%, that could translate to roughly 175,000 tons of lithium metal equivalent—enough to make Ukraine a notable European supplier. Some Ukrainian officials have claimed it’s one of the continent’s largest undeveloped lithium deposits, potentially rivaling Portugal’s 60,000-ton proven reserves. However, these numbers are speculative until validated by contemporary drilling and assays.

Exploration and development history

The deposit was first identified during Soviet geological surveys in the mid-20th century, but no significant mining occurred. After Ukraine’s independence in 1991, interest grew sporadically. In the late 2010s, the Australian firm European Lithium acquired exploration rights through its subsidiary, Millstone & Co, aiming to develop Shevchenkivske alongside the nearby Polokhivske deposit. The company estimated a resource base that could support a 20-year mine life, producing up to 20,000 tons of lithium carbonate equivalent annually. However, progress stalled due to permitting delays, local opposition, and the 2022 Russian invasion, which shifted investor focus.

In 2023, Ukraine’s government revoked several dormant licenses, including some linked to Shevchenkivske, as part of a push to reassert control and attract new partners. By early 2025, Kyiv has been marketing the deposit to Western firms, with tenders floated to companies from the U.S., EU, and Canada. No active mining has begun, but the site is seen as shovel-ready once security and funding align.

Economic potential

If developed, Shevchenkivske could be a game-changer. At current lithium carbonate prices (around $15,000-$20,000 per ton in early 2025), a fully operational mine producing 20,000 tons annually could generate $300-$400 million in yearly revenue, depending on market fluctuations. Its proximity to Europe—closer than Australian or South American sources—offers logistical advantages, potentially feeding battery plants in Poland, Germany, or Hungary. The deposit’s co-occurring minerals (tantalum, niobium) could also boost its value, as they’re used in electronics and aerospace.

Challenges:

- War Risks: Though outside the conflict zone, the broader instability in Ukraine deters investment. Security guarantees are a sticking point in negotiations with foreign partners.

- Infrastructure: No local lithium processing exists, so ore would need export for refinement—likely to Europe—until a domestic facility is built. Transport links in Kirovohrad are decent but would need upgrades for large-scale mining.

- Data Uncertainty: Soviet-era estimates lack the precision modern investors demand. A full feasibility study, including drilling and metallurgical testing, is overdue.

- Regulatory Hurdles: Past corruption and bureaucratic delays have frustrated developers, though Ukraine’s government has streamlined processes since 2023 to court Western capital.

Current status

Shevchenkivske remains untapped but is at the forefront of Ukraine’s mineral pitch to the West. President Zelensky has name-checked it in talks with the EU and U.S., offering joint ventures to unlock its potential. A U.S. proposal this month to claim 50% of mineral revenues in exchange for aid was rejected, but discussions with firms like Germany’s Vulcan Energy and Canada’s Lithium Americas are gaining traction. The deposit’s safe location and sizable reserves make it a priority, with Ukraine aiming to start exploration drilling by late 2025 if deals materialize.

In essence, Shevchenkivske is a high-potential asset—geologically rich, and strategically placed, but held back by war and underdevelopment. Were you looking for more on its mining prospects or its role in Ukraine’s broader strategy? (GROX /X) (@CSSDMacedonia)

Comments are closed, but trackbacks and pingbacks are open.